ri tax rate on unemployment benefits

Web Up to 25 cash back In recent years the employment security tax component generally has been around 275 and the job development tax component between roughly 2 and 5. Unemployment Insurance UI is a federalstate insurance program financed by employers through payroll taxes.

Can I File A Ssdi Claim While On Unemployment

Web For most Rhode Island employers the taxable wage base for calculating the Rhode Island unemployment insurance UI tax will be 23600 for 2019 compared with.

. 14 update on the state job and family services website. Web The states unemployment rate in April of 2020 had spiked to 17 and RIPEC predicted the state would have to pay out 1026 million in monthly UI benefits. By law the UI taxable wage base represents 465 of the average.

Web 2022 Rates. Web The Department of Labor and Training DLT today announced that tax rates for the Unemployment Insurance UI program will remain at Schedule H in 2022. Web Normally unemployment benefits are subject to both federal and Rhode Island personal income tax.

The Rhode Island Division of Taxation today provided guidance explaining that Rhode Islanders will be able to deduct up to 10200 of. RHODE ISLAND BUSINESSES will not see an increase in the unemployment insurance tax rates for 2022 according to the RI. Web Rhode Island is to delay the computation date used in unemployment tax calculations for 2022 under an executive order signed Oct.

Web In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum. Web Unemployment Insurance. Web Unemployment insurance tax rates in Ohio will range from 03 to 98 in 2023 according to a Nov.

Web The UI taxable wage base will be 24600 for most employers and 26100 for employers at the highest rate. Under federal legislation enacted on March 11 2021 if a taxpayer received. Web The Department of Labor and Training DLT today announced that tax rates for the Unemployment Insurance UI program will remain at Schedule H in 2022.

As a result of this action Schedule H with rates ranging from 12 percent to 98 percent will remain in effect throughout calendar year 2022. Web PROVIDENCE RI.

Apply For Unemployment Benefits Ri Department Of Labor Training

Bill Would Exempt Rhode Islanders From Tax On Unemployment Payments

Unemployment Compensation Trust Funds Federal Aid To States

Consumer Alert Rhode Islanders Could Owe State Taxes On Unemployment Wjar

Cares Act Measures Strengthening Unemployment Insurance Should Continue While Need Remains Center On Budget And Policy Priorities

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

Golocalprov Scam Email Claiming To Be Ri Division Of Taxation Prompts Warning By State Officials

How Our Unemployment Benefits System Failed The New York Times

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Tracking Unemployment Benefits A Visual Guide To Unemployment Claims

Unemployment Insurance In Rhode Island Ballotpedia

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Rhode Island Ranks 40th In Tax Foundation 2022 Business Tax Climate Index Rhode Island Public Expenditure Council

View All Hr Employment Solutions Blogs Workforce Wise Blog

View All Hr Employment Solutions Blogs Workforce Wise Blog

Rhode Island Unemployment Rate

Unlike Federal Government Ri Will Fully Tax Unemployment Benefits Wpri Com

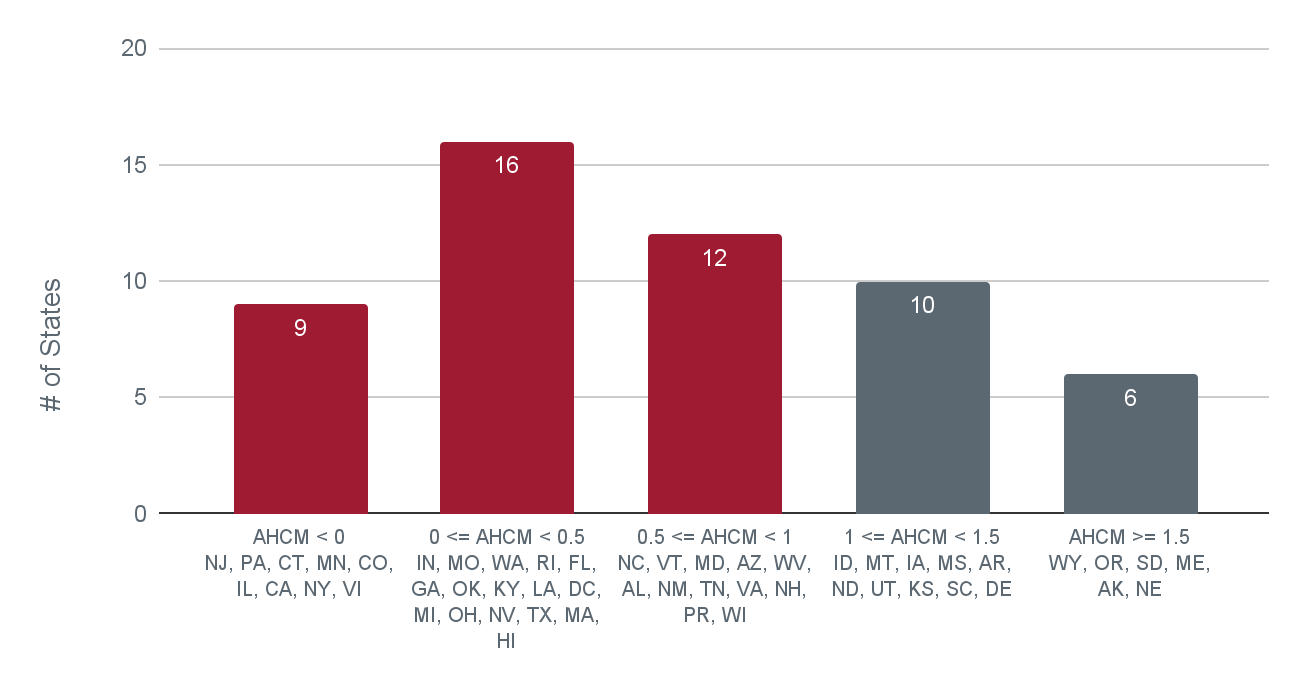

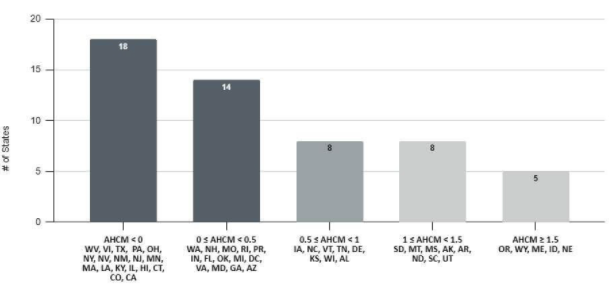

How Unemployment Benefits Are Calculated By State Bench Accounting