kansas auto sales tax calculator

If you have any questions about how Kansas sales and use tax laws apply to your business please visit the departments Policy Information Library on our web site wwwksrevenuegov or. How kansas motor vehicle dealers should charge sales tax on vehicle sales.

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

This rate includes any state county city and local sales taxes.

. Maximum Possible Sales Tax. For the property tax use our kansas vehicle property tax check. The latest sales tax rate for Olathe KS.

Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. You pay property tax when you initially title and register a vehicle and each year when you renew your vehicle tags and registration. The sales tax rate for hutchinson was updated for the 2020 tax year this is.

Some states provide official vehicle registration fee calculators while others. Kansas State Sales Tax. Use the Kansas Department of Revenue Vehicle Property Tax Calculator to estimate vehicle property.

Vehicle property tax is due annually. Kansas has a 65 statewide sales tax rate but also. Maximum Local Sales Tax.

There are also local taxes up to 1 which will vary depending on region. In addition to taxes car. Vehicle Property Tax Estimator Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle.

Kansas car tax is 273368 at 750 based on an amount of 36449 combined from the sale price of 39750 plus the doc fee of 399 minus the trade-in value of 2200 minus the. The sales tax in Sedgwick County is 75 percent. Kansas Vehicle Property Tax Check - Estimates Only.

Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. The most populous location in Butler County Kansas is El Dorado. Maximum Possible Sales Tax.

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. As far as all cities towns and locations go the place.

Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Average Local State Sales Tax. The sales tax in.

How to Calculate Kansas Sales Tax on a Car. Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year. Kansas State Sales Tax.

The December 2020 total local sales tax rate was also 6250. Multiply the vehicle price. Average Local State Sales Tax.

To calculate sales tax visit Kansas Department of Revenue Sales Tax Calculator. Youll get the real exchange rate with the low fee were known for. The current total local sales tax rate in Johnson County TX is 6250.

2020 rates included for use while preparing your income tax deduction. The average cumulative sales tax rate between all of them is 663. Maximum Local Sales Tax.

The minimum is 65.

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Kansas Auto Dealers License Guide Bryant Surety Bonds

Aug 2016 Out Of State Motor Vehicle Sales Tax

Missouri Sales Tax Guide For Businesses

2022 State Tax Reform State Tax Relief Rebate Checks

Sales Tax On Cars And Vehicles In New Mexico

What S The Car Sales Tax In Each State Find The Best Car Price

Dmv Fees By State Usa Manual Car Registration Calculator

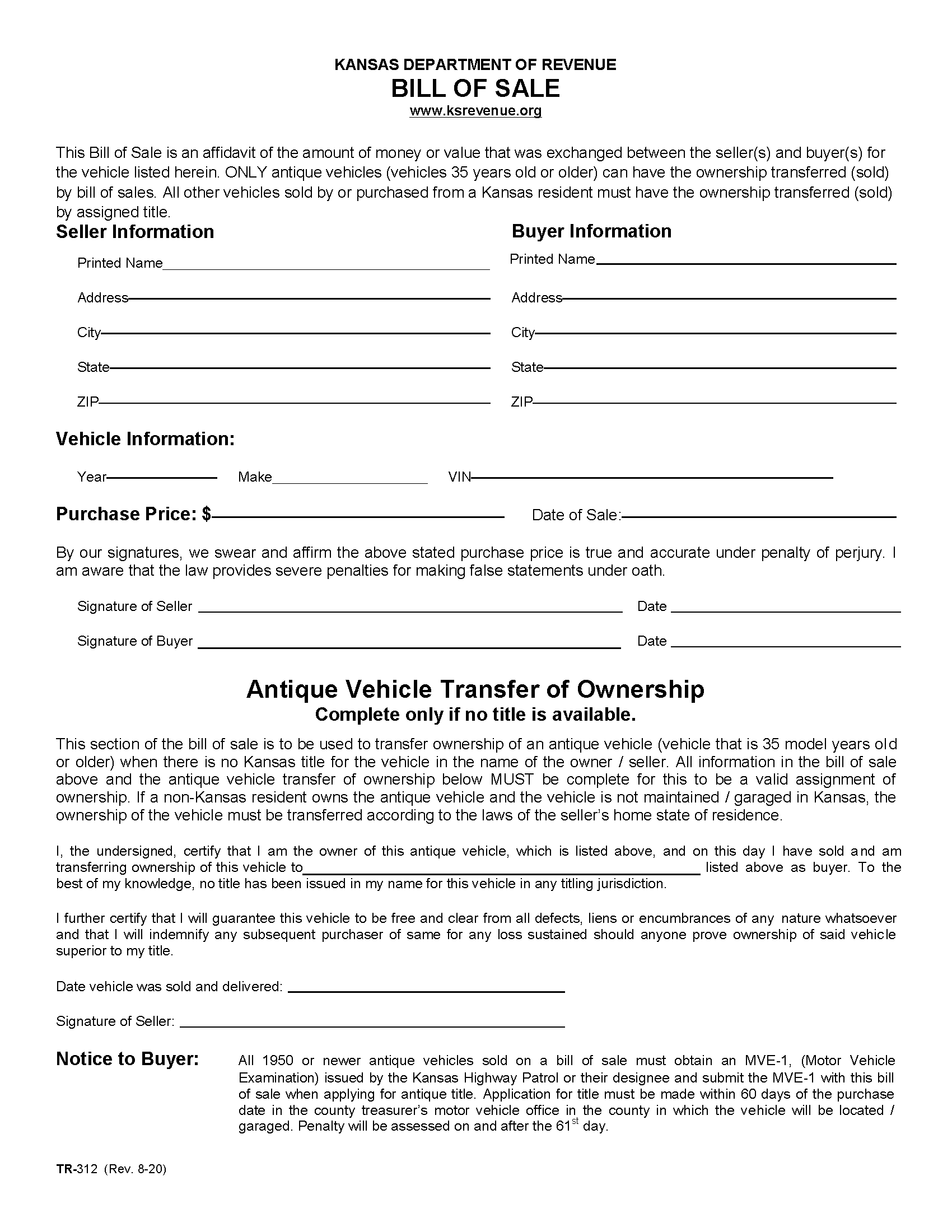

Free Kansas Motor Vehicle Bill Of Sale Form Pdf Word

How To Register For A Sales Tax Permit Taxjar

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Kansas Car Registration Everything You Need To Know

States With The Highest Lowest Tax Rates

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Sales Tax On Cars And Vehicles In Kansas

General Sales Taxes And Gross Receipts Taxes Urban Institute